at the American Petroleum Institute (API)

The 27th World Gas Conference kicks off next week in Washington, DC. Ahead of the gathering, SmartBrief connected with Marty Durbin, the Executive Vice President and Chief Strategy Officer at the American Petroleum Institute, to get his insights on the current state of the oil and gas industry.

LNG exports from the US are one of the key topics at this conference. What does API see as the next stage of growth for LNG exports?

The future of U.S. LNG appears very bright. With the successful first wave of U.S. LNG export projects either already online or nearing completion, it seems increasingly likely that a second wave of U.S. projects will move forward over the next few years. In part this is the result of tremendous global demand growth for LNG — especially in China — which has routinely exceeded expectations. Yet it’s also reflective of the enduring value proposition of U.S. LNG, which continues to attract a diverse set of buyers from multiple regions around the world.

The introduction of U.S. LNG into the global market has also initiated an exciting shift in many aspects of the LNG business model, especially in terms of pricing, contract duration and destination flexibility. We certainly expect these trends to continue. U.S. LNG developers are also exploring novel project structures and new liquefication technologies, all in an effort to meet the different needs of different types of buyers. The result is that LNG buyers now have an unprecedented number of options for procuring LNG, which in turn is fostering a more liquid and globally interconnected market — truly a new era for the LNG industry.

You’re moderating the session “The Shifting Sands of Shale Gas Abundance and Global Markets.” What topics around North American shale are you hoping to shine a light on?

The shale revolution underway in North America is not an accident. It is the result of North America’s unique private property protections, access to capital and embrace of free-market principles. We hope to cover a range of topics, including how the energy landscape continues to evolve quickly and the need to expand the nation’s energy infrastructure to keep pace with increased energy production. We’ll also discuss the ways the shale energy revolution continues to shape the energy markets and LNG exports. One of the panelists intends to provide a regional overview of the South American energy market, including market integration. Another will discuss the reasons the shale energy revolution happened here and the obstacles to a similar energy resurgence happening in Asia or Europe. Finally, we will discuss the long-term outlook for market oversupply.

The oil and gas industry is changing rapidly. What issues are most top of mind for API members as they navigate new market conditions?

Progress on infrastructure and markets is the key.

Immediate concerns for the industry’s health include the recent U.S. imposition of import tariffs on steel and aluminum as well as the emergent trade war with China, Europe and potentially others on chemicals and other manufactured products.

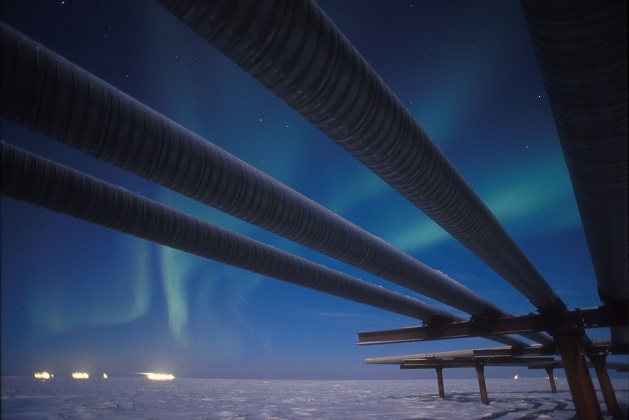

The natural gas and oil industry relies critically on specialty steel products that are not manufactured in the United States, and delays and increased costs could jeopardize jobs and cost millions of dollars every day. Moreover, some nations have negotiated with the Trump administration to implement quotas as an alternative to tariffs – creating a scenario under which supply may not be available from certain trading partners at any cost.

Importantly, our industry is integrated across the value chain as well as geographically across country borders, so while it may be easy to start trade wars, they’re neither practical nor in our country’s best interest.

The natural gas and oil industry – including upstream development, midstream processing and pipelines, downstream refining and petrochemicals as well as export infrastructure – has invested hundreds of billions of dollars into the United States over the past several years as part of the energy renaissance. These projects depend on infrastructure expansion as well as unfettered access to export logistics and markets.

As API member companies have placed many of their proverbial eggs into the U.S. basket, the experience they have in completing multi-billion dollar megaprojects and establishing new markets for their products is critical to the success of these investments as well as the prospects for future waves of investment, which are the crux of the energy renaissance.

While our industry should take tremendous pride in its recent achievements – including record U.S. natural gas, oil and NGL production, record refinery throughput, record exports of crude oil and natural gas, and a U.S. petroleum trade balance that has shrunk to its smallest and most favorable position in more than 50 years – we cannot be complacent and must continue to highlight our where cooperative outcomes on infrastructure and trade policies are at critical junctures for the health of the industry and, frankly, the U.S. economy.