Giancarlo stays the course on KISS

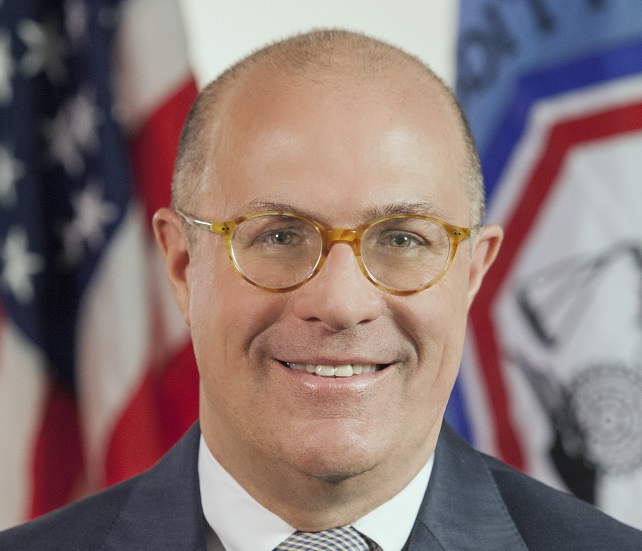

On the heels of a keynote speech that drew a standing ovation at last year’s FIA Boca, CFTC Chairman J. Christopher Giancarlo took the stage today and offered more details about his vision for the future of the Commission’s structure and approach to regulation.

Giancarlo offered an update on some of the initiatives associated with Project KISS, an effort to implement a “Keep It Simple, Stupid” approach to crafting regulations. Giancarlo said the “right-sizing” of regulations after years of Dodd-Frank rule expansion involves being able to see where the market is headed; and he offered a sports analogy to illustrate his point:

“The great Wayne Gretzky once explained that the secret to his success was that he skated to where the puck was going, not to where it had been. In the CFTC’s work overseeing the world’s most dynamic markets, we must also anticipate the development and direction of markets and “skate” to where they are going.”

To that end, Giancarlo also touted the CFTC’s eagerness to embrace new technologies that will not only shape markets of the future, but also aide the Commission in it regulatory work.

“In less than a year of operation, LabCFTC has met with over 150 FinTech innovators, from startups to large institutions and from lower Manhattan, to Chicago to Silicon Valley.”

While the CFTC has been quick to explore technological solutions, Ginacarlo insisted the Commission would slow its roll when it comes to crafting rules around position limits.

“Any final position limits rulemaking should be done properly by a full Commission of five commissioners. It will ensure that any final position limits rule is indeed final and stands the test of time and changes in future administrations.”

In a speech full of comments on rules and technology, Giancarlo saved his most critical words for a rule about technology.

“Regulation AT was an initiative of my predecessor, Chairman Massad. My position was and continues to be that, while there were some good things in the proposal, there were other things that were unacceptable and perhaps unconstitutional. … At heart, Reg AT is a registration scheme that would put hundreds if not thousands of automated traders under CFTC oversight, a role for which our agency has inadequate resources.”

Even if Giancarlo’s speech didn’t garner a standing ovation this year, it is clear that most of his views align closely with the majority of market participants. However, how quickly he can turn those views into rulemakings remains to be scene.

A testy look back at the financial crisis

In what was undoubtedly the most feisty FIA Boca session in quite some time, a distinguished panel observed the 10-year anniversary of the beginning of the financial crisis by looking back at the causes, responses and lasting lessons from the dark days of 2008.

Barney Frank opened the session by crediting noting how bipartisanship played a big role in the regulatory response and openly questioned if such a response would be possible amid today’s more divided political landscape. However, the conversation soon took a turn toward arguments based on philosophical and/or party lines. Even with 10 years of hindsight, the panel could not agree on the actual cause of the financial crisis, nor could they agree on whether or not letting Lehman Brothers fail was a wise choice.

Thomas Russo, who was at Lehman Brothers before the crisis and at AIG during and after the crisis, said the markets never thought anyone would be stupid enough to let Lehman fail. Craig Donohue, who is now the Chairman and CEO of OCC, but was the boss of CME Group at the time of the crisis, concurred that letting Lehman fail was a mistake.

Frank countered that the only reason Lehman failed was because there were no institutions in the US that were big enough to take it over. Frank also noted that conservative Republicans were initially happy that there had been no intervention to save Lehman, but changed their tune a day later after seeing how the market reacted to the collapse.

Russo shared one of the most insightful observations when he said the mistake US and UK regulators made regarding revolved around their misconception that the problems at Lehman were an individual company issue and not a systemic issue.

After that, the panel devolved into a series of accusations about whose accounting was wrong, whose recollection of events was wrong and what policymakers should have done to prevent or respond to the crisis.

The key takeaway from this unusually combative panel is that confusion still reigns. Ten years later, some of the smartest minds still disagree on whether Lehman should have been allowed to fail. They still disagree on if TARP funds were repaid in full. And they disagree on whether Fannie and Freddie continued to bleed money after they were put into receivership.

And all that disagreement isn’t going to stop any of the parties from continuing to make their case: After the fireworks on stage, Frank continued his defense of Dodd-Frank on the sidelines of the conference.

Cboe pushes back on VIX narrative

The brain trust of Cboe used a media event at FIA Boca to challenge reporting that seemingly points the finger at their exchange for losses related to the VIX during market volatility in early February. Cboe Chairman and CEO Ed Tilly pointed out that the products that blew up on February 5 were products offered by banks and other market participants. And while those products were linked to the swings in the VIX, Cboe had nothing to do with those losses.

On the notion that the VIX had been manipulated, the Cboe team refuted the idea by citing feedback from professional traders who attended Cboe’s annual Risk Management Conference last week. Those traders said the idea that the VIX could be manipulated is foolish because it implies they would stupid enough to not hedge their positions.

Cboe also announced it has plans to expand its footprint in the area that is the hottest topic at this year’s conference: cryptocurrencies.

When the conversation turned to the steel and aluminum tariffs recently announced by the Trump administration, the leadership team at Cboe noted how Brexit gave the exchange a chance to focus on geopolitical risks.

As Cboe President and COO Chris Concannon explained, “We’ve seen trade wars before. This is more of a trade battle than a trade war.”

Quintenz comes out swinging

CFTC Commissioner Brian Quintenz had harsh words for the European Union during a speech here in Boca. A fired up Quintenz said a proposal by the EU to “re-neg” on a 2016 agreement on regulatory equivalence was unacceptable. Quintenze said he would respond by refusing to support any and all requests for cross-border relief from European entities until the US received assurances that the bulk of the 2016 pact would be honored by European regulators.

Exchange leaders discuss volatility, tech and other market trends

Leaders from CME Group, Eurex, Nasdaq, SGX, ICE, and Cboe discussed challenges, opportunities, and how to build a sustainable future for listed derivatives. My favorite part of the panel was when a seemingly ordinary question was asked: What exactly is an exchange? the answers were enlightening.

Nasdaq President and CEO Adena Friedman flipped the script a little bit noting:

“We are a technology company serving the capital markets.”

Not surprisingly, ICE Chairman and CEO Jeff Sprecher said exchanges are all about data:

“Today it’s about all the information. Data that we get is assimilating to get to price discovery.”

But the soccer fan in me loved the answer from Eurex CEO Thomas Book:

“We are a soccer field. We provide good grounds along with referees (regulators) in order to provide a fair playing field for players.”

Leave it to the boss of a German exchange to make the perfect soccer analogy. Bravo, Mr. Book.

Bcause is ramping up

In a chat on the sidelines of Boca, I got a chance to learn more about Bcause, a new venture offering a one-stop shop for cryptocurrencies. The platform promises to offer a digital mining facility, spot market, regulated derivatives exchange and clearing house. Chief Executive Officer Fred Grede brings a Hall of Fame background in the exchange space to the platform, while Founder and CMO Thomas Flake has the firm set for growth. Bcause currently has 11,000 machines up and mining for what are almost exclusively commercial clients, but has contracts to add an additional 83,000 machines.

Grede and Flake say the impetus behind the one-stop shopping business model is all about the customer experience. And that experience is about more than convenience, but also customer service.

“We want to be Nordstrom’s, not Walmart.”

Currently operating out of space in Virginia Beach, Va., Flake said the firm is looking to expand either in Pennsylvania or Scandinavia.

More from Boca

- FIA PTG released a white paper on liquidity in today’s markets

- Coinfloor set its sights on launching a futures exchange for digital assets.

- CloudMargin unveiled a new website experience for its users.

Beyond Boca

The Senate voted to roll back financial regulatory reforms.

Hanweck dove into the data surrounding the volatility shock of February 5.

Clearly the CEO of Wells Fargo has been deserving of a raise.