After Beyond Meat’s spectacular IPO and Impossible Foods’ recent $300 million funding round to help it meet global demand, there’s little question that the rise of plant-based foods is more than just a passing trend.

And a visit to the first Plant Based World Conference and Expo in New York City last week would put anyone’s lingering doubt about the strength and potential growth of the industry to rest.

The show was the latest sign that the plant-based food industry is moving rapidly from a niche player to the mainstream, Plant Based Foods Association Executive Director Michele Simon said during the keynote panel.

She and others throughout the two-day show stressed that the industry is growing faster and attracting new sources of investment not because the number of vegetarians and vegans in the world is growing but because more people are opting for flexitarian diets that remove more meat, dairy and eggs from the plate.

The association launched three years ago with 22 members and today there are more than 140. They’re companies of all sizes that make at least one-plant-based product line, and some that started out as small startup members have grown rapidly to the next level, she said.

“The consumer focus on health in general is part of that,” she said.

But to win and keep those health-conscious consumers, the number one priority still has to be taste.

The food must be delicious, panelists and speakers stressed, and the rise of companies that are making better options available in retail, restaurant and foodservice channels has also been an essential component of the growth.

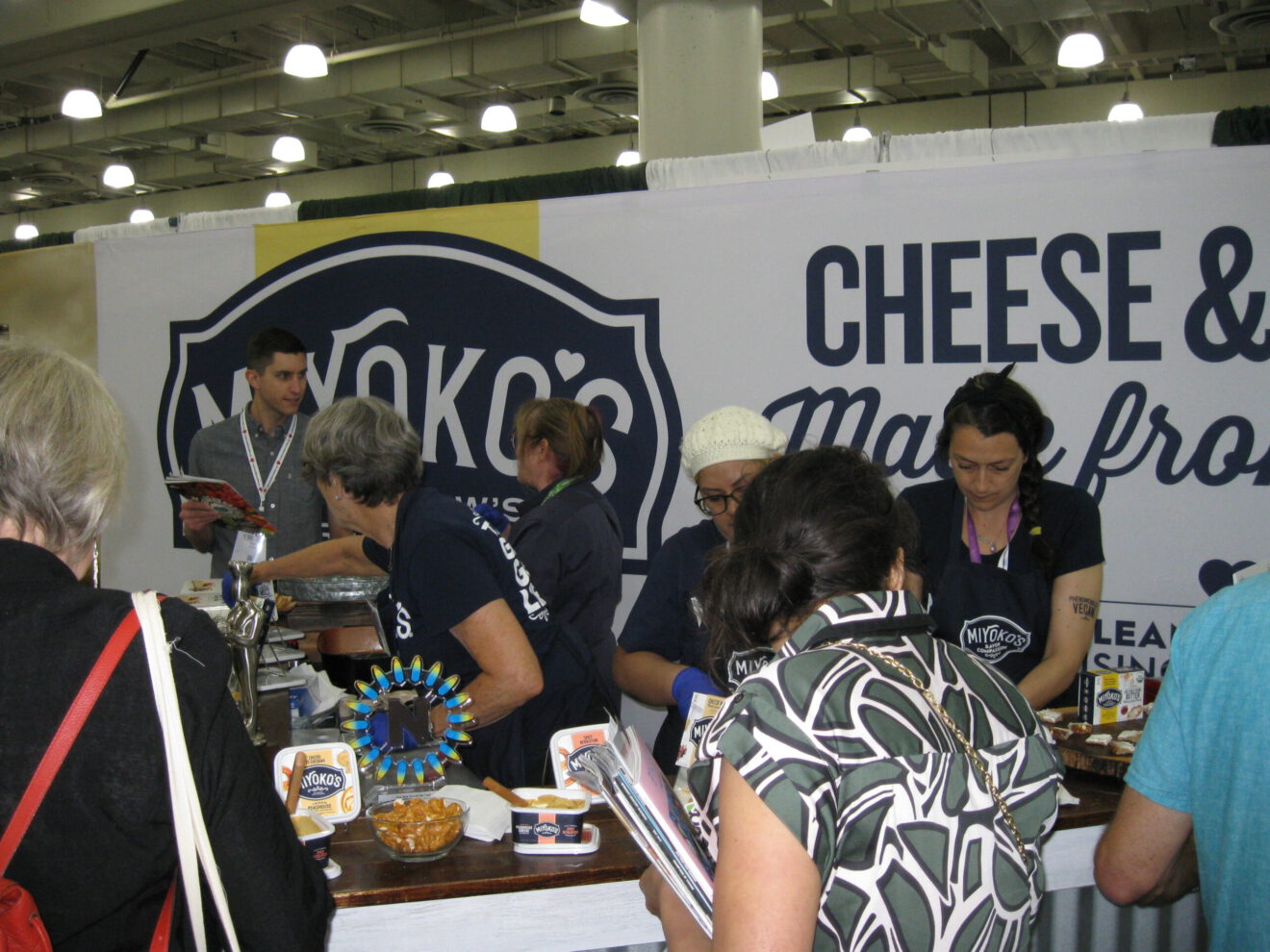

The expo floor was packed with companies sampling the newest plant-based burgers, hot dogs, cheeses and milks. And in educational sessions, entrepreneurs, investors and retail and foodservice experts shared insights into where the industry is headed.

One consistent theme was the question of how to scale up to meet growing demand without losing authenticity.

For Miyoko’s founder Miyoko Schinner, one key is finding ways to maintain the company culture during periods of rapid growth. The plant-based cheese brand now has its products in 12,000 stores and has grown to 112 employees, and its sales are doubling year over year, she said during a panel of successful plant-based food entrepreneurs who shared their stories and wisdom.

As consumer demand grows for plant-based foods, it’s gotten much easier to land a place in grocery stores, and products that once might only be found in natural food markets are now available in major grocery chains across the country.

Plant-based milks and other dairy replacements have moved from separate sections to the mainstream dairy case in many stores and plant-based meat replacements are making their way into the meat section. Those shifts are driving higher sales, but it also puts pressure on brands to keep shelves stocked.

“Retailers are avidly looking for products like ours as they’re trying to expand their plant-based sets,” Schinner said.

That makes landing a retailer relatively easy, but the challenge can be keeping up.

“You have to fill that shelf space or you could lose it,” she said.

The flipside of that trend is finding and filling your niche to stand out as competition grows. As the success of Impossible Foods and Beyond Meat demonstrate strong demand for more meat-like plant-based alternatives, others including Lightlife and Nestle-owned Sweet Earth are introducing their own versions of burgers and other beef-like products.

Keeping your branding and marketing in-house for as long as possible can be key to your ability to stand out in a growing field, said Sadrah Schadel, co-founder of No Evil Foods.

Schadel and her partner, Mike Woliansky, started the plant-based meat company after realizing that they were growing nearly all their food in the garden, with the exception of plant-based meat alternatives. They learned to make seitan in their home kitchen and created a product that proved popular at local farmers markets.

“We literally went door-to-door, we didn’t know how any of this worked,” she said.

That lack of industry savvy may have worked in their favor. The pair walked into Whole Foods Market with product samples and ultimately won a place in the stores.

The product came in a plain brown wrapper with a distinctive black-and-white label, and the packaging has since been revamped with designs that stand out and still reflect the brand’s personality.

The small-batch seitan-based products with quirky names like Comrade Cluck and The Stallion Italian Sausage have taken off and the company recently opened its own manufacturing facility, but the founders keep a hands-on approach to the brand they created.

“Keep your brand close,” she said. “That’s what will keep them buying from you. Don’t outsource your brand.”

Having a distinct brand personality is more vital than ever with so many startups and big companies launching new, competing products.

“There’s a ton more competition now,” said Annie Ryu, founder and CEO of The Jackfruit Company.

Ryu was working on a project in India before starting Harvard Medical School when she discovered jackfruit and met the farming families who were producing it. The giant prickly fruit has two distinct phases and she originally started with the idea of producing a dried version of the mature fruit before realizing that the young jackfruit had entirely different qualities that make it an ideal meat replacement.

Today, her company commands about 60% of the retail market for jackfruit products with items like BBQ Jackfruit and jackfruit-based meals made with spices and vegetables. The company sources the fruit from sustainable growers in India, and it’s helping some of them transition to organic.

Her biggest challenge at the beginning, she said, was educating consumers who had never heard of jackfruit before.

That lack of information was a double-edge sword. While there was a learning curve for consumers, there was also literally no competition. That open playing field meant the company had the luxury of time to build its brand.

That’s changed dramatically as new players are continually getting into the market and trying to stand out, she said.

“There’s a ton more competition now. Time is not on your side the way it might have been before,” she said.

But even that competition is proving a blessing to the industry as it moves into the next phase of growth, Schinner said.

“Competition is growing the category,” she said. “We can’t grow this category as single brands, we need competition. There’s room for all of us and we need to cooperate and take market share from animal agriculture.”

Related stories:

- A new wave of plant-based food makers is focused on fish

- Startups make plant-based meals more convenient

- Plant-based foods, off-premise tech solutions stood out at restaurant show

____________________________________________

If you enjoyed this article, sign up for Restaurant Smartbrief to get news like this in your inbox, or check out all of SmartBrief’s food and travel newsletters as we offer more than 30 newsletters covering the food and travel industries from restaurants, food retail and food manufacturing to business travel, the airline and hotel industries and gaming.