In this article, we summarize the latest consumption trends and moves from Douyin — which is the Chinese version of TikTok — and how they impact international brands seeking new business growth in China.

While similar, Douyin and TikTok have their differences. Both are known for their addictive, entertaining short-form video format. As the forerunner to TikTok, Douyin offers a glimpse of what is possible in future TikTok features. One of the most notable differences is Douyin’s in-app store provides superior e-commerce and purchasing capabilities than the current TikTok app. Douyin users can seamlessly purchase products directly within the app by clicking on linked products, which direct them to a product page where they can check out with their preferred payment method.

Also, there is a large selection of products and services available on Douyin, and includes things like apparel to the ability to book hotels.

Douyin sees e-commerce as next promising opportunity

Douyin’s first official 618 Good Product festival was a success and far exceeded everyone’s expectations in June. From June 1 to 18, Douyin’s livestream totaled 40.45 million hours, an impressive increase of 97% year over year.

The success of the 618-gala convinced Douyin to increase its bet on the e-commerce business with the Douyin 818 Trendy Goods Festival, which kicked off on Aug. 6 and witnessed a new milestone in sales growth.

Douyin 818 Trendy Goods Festival used “Discover Good Product” as its theme. The company fed into Chinese consumers’ widespread interest for e-commerce through pan-mall scenarios like Douyin Mall, Douyin Search, Shop Window, Good Item List, etc., and incorporated various content scenarios like short-form videos and livestreams.

In August, Douyin announced internally that part of the middle-tier business will be handed over to the service team of the Douyin E-commerce division, and the industry operations of Douyin e-commerce will be divided into content business and shelf business.

The updated positioning highlights Douyin’s ability to draw customers through a variety of channels, including short-form videos, livestreaming, its search feature and other channels to help it expand its reach.

Douyin has enjoyed impressive growth in the first half of the year. The sales in the first six months of the year surged 150% YoY, and the sales volume soared by 142% YoY.

The number of brands and stores participating in 818 events was up 20% YoY, and 114% YoY respectively, and short videos linked to shopping carts (directly driving traffic to stores) have been played 83.2 billion times.

Though Douyin hasn’t disclosed precise figures on sales results, the rapid growth of Douyin e-commerce also proves that livestreaming e-commerce is further unlocking consumer demand.

Livestreaming e-commerce platforms are giving traditional marketplaces a run for their money this year. Traditional e-commerce platforms only saw slight growth in e-commerce sales (0.7% YoY), while livestreaming e-commerce recorded a surge of 124% YoY.

Douyin e-commerce, which became a standalone business unit only two years ago, is quickly stealing traffic from e-commerce giants like Alibaba and JD.com, thanks to its wildly popular social content.

Douyin’s gross merchandise value (GMV) in 2021 was 3.2 times higher than in 2020 due to increasing its e-commerce initiatives over the previous year. The number of users who purchased on Douyin grew 69% YoY.

Youth are emerging as power consumers

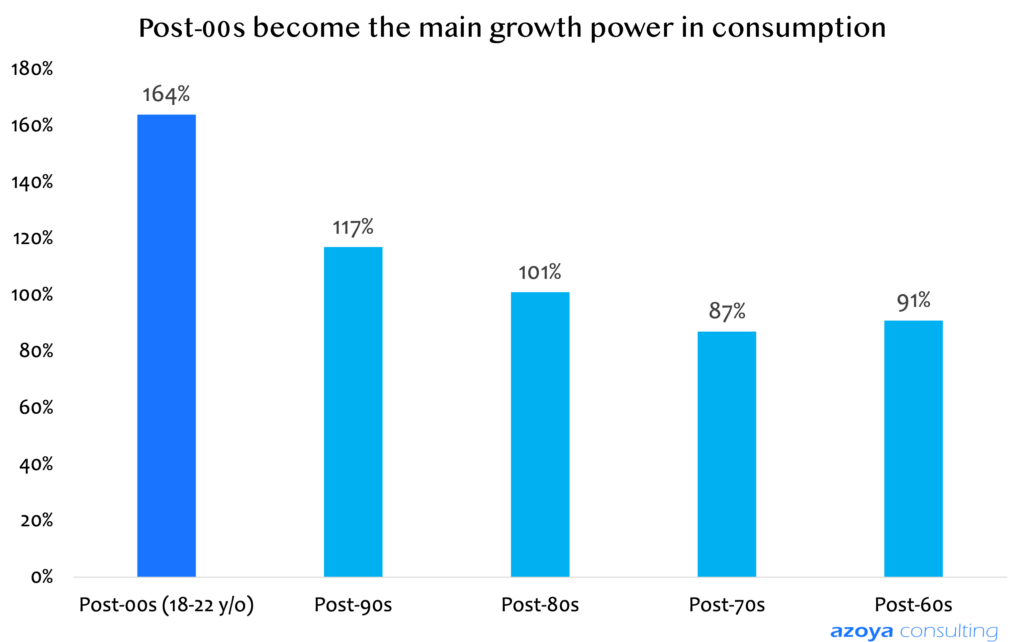

Those born in 2000 and since have become the “new power” of 618 consumers, with their GMV increasing 164% YoY. GMV from consumers born 1990-99 and 1980-89, respectively, also increased by 117% and 101% from the same period last year.

And these younger customers have a faster growth rate, higher per capita turnover, and are more willing to try new products. They want something different from the previous generations.

Compared with standard products widely available in the market, consumers (born 1990-1999 and 2000-2009, respectively) prefer products with unique personalities. They think innovation is the most important reason to buy, as well as scarcity. Once too many people have the same item, they desire new brands and products that offer alternatives.

One lifestyle report in China proves this trend. Nearly 60% of millennial consumers are willing to try niche brands. Niche brands in China often have strong images and are perceived to offer high value, and it’s this type of reputation that drives interest from young Chinese consumers.

Generation Z’ers have strong spending power and their growth rate is the fastest of all demographics. In China, Gen Z spent RMB 4 trillion ($620 billion US) in 2020. In 2021, nearly 300 million Gen Z’ers were expected to leverage consumption spending of RMB 5 trillion ($740 million US), the Gen-Z Decoding Analysis 2021 forecasts.

Key trends that have taken Douyin by storm

As one of Douyin’s annual major shopping events, the 818 Goodies Festival is now in its third year.

The rise in the number of participating merchants and livestream hours has driven sales growth in 23 categories, with apparel & lingerie, beauty, jewelry & accessories emerging as the top three categories during the first half of 2022. Notably, the growth rate of furniture and building materials, medicine and health supplement, and pet products was more than 400%, showing sufficient potential for the growth of niche industries on the platform.

According to the consumption trend among all categories of Douyin e-commerce this year, the amount of sales earnings and sales volume of the apparel & lingerie category is far beyond other categories. Apparel & lingerie occupies first place in sales volume and accounted for nearly 31% of the sales, followed by smart home appliance and beauty, 10.43% and 10.38%, respectively.

Notably, at-home beauty devices have become the main hot-selling product in the beauty category. YA-MAN recorded a 2,457% skyrocketing rise in its Douyin official flagship store sales. Domestic players, including AMIRO and ALL Natural Advice, also made considerable sales gains.

Along with the increase in consumer acceptance of medical aesthetics, at-home beauty devices also have become one of the latest trends. As the price of medical aesthetic items can easily be in the tens of thousands of yuan, they are also expensive for many consumers even if they can achieve relatively good results. At-home beauty devices are relatively cheaper, simple to operate, and easy to carry, so they are favored by consumers, especially the post-90s consumer group.

Chinese customers’ focus on skin care and health care has led to growth in the performance of players in this segment. Collagen has grown rapidly in the past year and has quickly become a member of health care products that cannot be ignored in the recommendation of various celebrities and influencers.

Under the skin care experience of internal and external use, vitamins also have attracted much attention among health care products. According to analysis, the vitamin B group has seen its sales increase by 1,000 times compared with the same period in 2021, making it a new star in the industry.

In terms of annual growth rate during the mid-year event, luxury goods, virtual top-up service, and outdoor sports ranked as the top three. According to Deloitte’s “Top 100 Luxury Companies 2021” list, more than 60% of the companies have had their brands debut on Douyin.

The pace of luxury houses launching on the Douyin e-commerce platform will drive the luxury industry to prosper.

Premium brands also using Douyin’s e-commerce

Behind the strong 618 results, Douyin has acquired several premium beauty brands to launch their presence in terms of Douyin’s official account, flagship store, influencer livestreaming and self-livestreaming.

Douyin unveiled flagship stores for brands in March 2021, which were designated for brands and retailers selling their products & increase credibility. It requires applicants to submit trademark documents to guarantee product authenticity.

Earlier, Erno Laszlo, Estee Lauder, L‘Oreal Paris, The history of WHOO, Avene, Olay, Ulike and more have leveraged Douyin’s “interest e-commerce model” to expand their market. For example, as of June 16, Estee Lauder’s sales on Douyin have exceeded 100 million RMB ($1.5 million US) from the 618 event.

Take high-end beauty brand Erno Laszlo as another example. It has seen rapid growth in the past six months since it launched on Douyin at the end of December 2021, with a unit price of 1,200 RMB ($178 US) per customer. According to Douyin E-commerce Holiday Sales Report, the GMV of Erno Laszlo’s self-livestreaming on Member Day on April 22 surpassed 2.6 million RMB ($385,000 US), and the number rose to over 3 million RMB ($444,000 US) on May 19.

In May, Lancome made its debut on Douyin via a grand opening-themed livestream. Lancome sold more than 1 million RMB ($150,000 US) in 10 days and 10 million RMB ($1.5 million US) in total sales within a month of its launch. The overall transaction sales for the just finished “Douyin 520 Confession Season” were 5 million RMB ($745,000 US).

As a high-end cosmetic brand within the L’Oreal Group, Lancome is a global beauty industry trendsetter. Lancôme’s entry indicates that international premium brands will set off a new “storm” with Douyin e-commerce.

Douyin is constantly optimizing its features and functions. When fans click on Lancome’s official livestream, they are invited to join the brand membership in various pop-up windows, including shopping carts and the store’s home page.

Will Douyin become the next key channel for beauty brands?

Yes. Douyin’s youthful tone has attracted many high-end houses as a shortcut to approaching China’s growing Gen Z population, and leading brands such as Louis Vuitton, Dior and Cartier are already on board.

This has been proven by the international brands continuing to set up flagship stores in a row in Douyin. From the beginning of Q2 through June, ALBION, EltaMD, Farmacy, Augustinus Bader, and Benefit have adopted the Douyin flagship store as their latest e-commerce sales channel in China.

With two months to go until Single’s Day, Douyin has reinforced its influence in the e-commerce market. No doubt this year’s 11.11 (Single’s Day shopping festival in November) will inspire brands to rely even more on Douyin to connect with Chinese shoppers.

Franklin Chu is managing director U.S. for Azoya International, a provider of turnkey cross-border e-commerce solutions to assist retailers looking to expand into China through a cost-effective and lower risk method. To date, over 35 retailers in 11 countries are partnering with Azoya to expand into China with ease.